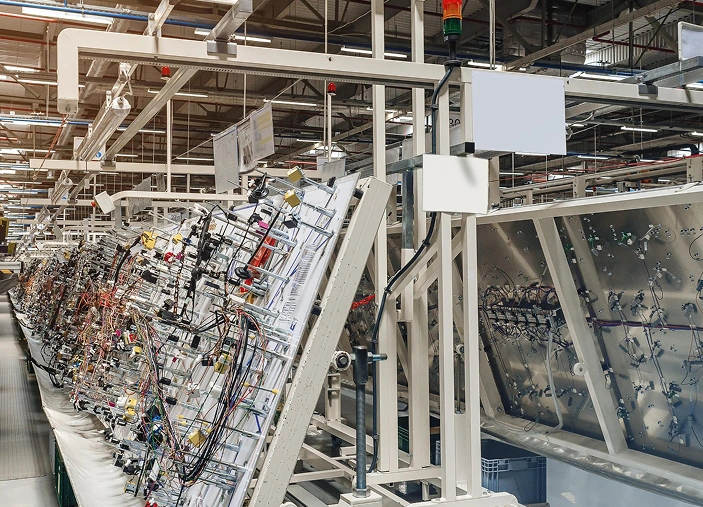

Your Specialized Sell-Side Advisor for Wire Harness and Cable Assembly Manufactures.

We’ve built and sold businesses—now we help others do the same.

At Blue Valley Capital, we specialize in sell-side advisory and exit readiness for wire harness and cable assembly manufacturers. As former owners with successful exits of our own, we understand the personal and financial weight of selling a business.

We combine that firsthand experience with a strong track record as Sell-Side advisors, bringing trusted buyer relationships, disciplined execution, and industry insight to every engagement. The result: clients who are prepared, well-positioned, and able to exit on their terms.

At Blue Valley Capital, we leverage specialized, firsthand experience in the wire harness and cable assembly industry to guide business owners through the sale process with clarity, care, and strategic focus. We understand the value behind what you’ve built. We are committed to helping you realize that value through professional sell-side advisory, tailored exit planning, and trusted guidance at every stage.

A sell-side advisor manages the entire process of preparing for and executing the sale of your business, which includes valuation, buyer outreach, negotiations, due diligence, and closing.

At Blue Valley Capital, we go beyond traditional advisory. We work exclusively with wire harness and cable assembly manufacturers, bringing both operational experience and M&A expertise specific to this sector. We are not business brokers; we are strategic advisors who know your industry inside and out and serve as your advocate every step of the way.

The best time to begin planning your exit is well before you’re ready to sell, ideally years in advance. Early preparation positions your business for maximum value and a smoother transaction.

Our proprietary HarnessPoint Exit Readiness Program is designed to help you lay the groundwork early, reduce deal risks, and strengthen the attributes buyers care about most.

HarnessPoint is a structured exit readiness program tailored specifically for owners of wire harness and cable assembly businesses who are considering a sale within the next 1 to 3+ years.

It helps you prepare across key areas, including but not limited to: Finance, Operations, Customer and Supplier Relations, Employee Dependencies, Compliance, and Post-Sale Continuity, so your business commands a premium valuation and attracts the right buyers. Whether you’re ready to sell soon or want to be prepared, HarnessPoint provides a clear, actionable roadmap to a successful exit.

Most owners underestimate the time it takes to prepare. Your business may be ready if you have:

– Consistent revenue and profitability

– Accurate, clean financials

– Diversified, long-term sticky customer relationships and competitive moat

– A leadership team that can operate without you

Even if you’re not quite there, taking proactive steps now can significantly increase your company’s value and reduce execution risk when you are ready to sell.

The value of your business is ultimately determined by what a qualified buyer is willing to pay, based on factors such as financial performance, customer relationships, growth potential, and risk profile.

In the wire harness industry, valuations are typically based on a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

At Blue Valley Capital, we deliver market-based valuations tailored to your unique business, providing a clear and realistic view of what your company may be worth in today’s M&A landscape.

A sell-side advisor helps business owners prepare for and execute the sale of their company—managing valuation, buyer outreach, negotiations, and due diligence. Blue Valley Capital is different. We work exclusively with wire harness and cable assembly manufacturers and bring decades of operational and M&A experience in this sector. Principal Greg Shine offers firsthand insight as a former owner and successful seller. That real-world perspective allows us to guide you with clarity, precision, and confidence.

A sell-side advisor helps business owners prepare for and execute the sale of their company—managing valuation, buyer outreach, negotiations, and due diligence. Blue Valley Capital is different. We work exclusively with wire harness and cable assembly manufacturers and bring decades of operational and M&A experience in this sector. Principal Greg Shine offers firsthand insight as a former owner and successful seller. That real-world perspective allows us to guide you with clarity, precision, and confidence.

A sell-side advisor helps business owners prepare for and execute the sale of their company—managing valuation, buyer outreach, negotiations, and due diligence. Blue Valley Capital is different. We work exclusively with wire harness and cable assembly manufacturers and bring decades of operational and M&A experience in this sector. Principal Greg Shine offers firsthand insight as a former owner and successful seller. That real-world perspective allows us to guide you with clarity, precision, and confidence.

A sell-side advisor helps business owners prepare for and execute the sale of their company—managing valuation, buyer outreach, negotiations, and due diligence. Blue Valley Capital is different. We work exclusively with wire harness and cable assembly manufacturers and bring decades of operational and M&A experience in this sector. Principal Greg Shine offers firsthand insight as a former owner and successful seller. That real-world perspective allows us to guide you with clarity, precision, and confidence.

A sell-side advisor helps business owners prepare for and execute the sale of their company—managing valuation, buyer outreach, negotiations, and due diligence. Blue Valley Capital is different. We work exclusively with wire harness and cable assembly manufacturers and bring decades of operational and M&A experience in this sector. Principal Greg Shine offers firsthand insight as a former owner and successful seller. That real-world perspective allows us to guide you with clarity, precision, and confidence.